U.S. Dollar

History:

From a Gold Standard Currency

to a Fiat Money System

x

This

1928 ten dollar gold certificate is an example of when U.S. Dollars

were still backed by the Gold Standard.

We live in a time of near

invisible money. When we pay for goods or

services we have a multitude of options other than dumping cash on the

counter. Our wallets are stuffed with credit cards that help us buy all

the things we need without ever seeing a real dollar exchange hands.

Our bank accounts are digital blips in an electronic world mostly

revealed to us through account statements rather than in actual cash in

hand. The barter and trade culture of the distant past,

necessary for the transfer of goods between parties but incredibly

inefficient, has evolved in the United States into a highly efficient

federally regulated fiat money system that is now almost unrecognizable

next to its simple origins.

In 75,000 B.C. snail shells were currency in some parts of South

Africa. In Aborginal Australia ochre (a color pigment made from

the earth) was used. Many early

societies adopted jewelry, usually shell, ivory, or other rare

commodities, as a means for barter and wealth savings. Much of the time

it was often key goods that found themselves as the going currency,

such as in the early British Colony of South Wales in Australia where

rum became the trade good of choice.

Trade beads such as those

pictured to the left are a far cry from today's electronic economy.

Whether beads, conch shells,

animal furs, rare metals, or something else, societies have always

needed some mode of transferring goods to those who need them in a

manner that is efficient for both sides. It is a natural market

phenomenon that traders are looking for a fair trade. But what if the

currency is easily counterfeitable, or the goods to be traded come from

opposite seasons of production, or politics are allowed to take

precedence over monetary stability? The evolution of good money

systems is an evolution of efficiency. The economic history of

man is littered with examples of failed currency systems.

Left: Zimbabwe dollars have experienced an

inflation rate well over 7000% from 1998 to 2007.

Right: In 1923 in the Weimar Republic (German state from 1919 to

1933), it took 1 trillion marks to buy one U.S. dollar. The note

pictured is 50 million marks.

Even in these

modern times, challenges remain. Anyone with the

desire can open a newspaper to the financial section and read about the

ongoing demands of maintaining an efficient monetary system.

Articles on the US deficit, on the decline of dollar against a huge

basket of foreign currencies, issues of inflation or deflation, are

daily reads. But how did The U.S. Dollar get here? What were the

specific motivations and designs that led from trading beaver pelts for

beads at the Hudson Bay Company to a world of near invisible dollars

backed by nothing but a government promise of value?

The history of the U.S. Dollar formally begins in the mid-1780's when

it was decided that the term Dollar would be the official measurement

of the monetary system in the United States. This seemed a reflection

of the fact that Americans were already comfortable with the word

Dollar since the Spanish currency in circulation at the time was of the

same name. In 1791, in what seems a natural progression, the

first U.S. bank opened its doors. From there The Dollar's path

becomes very intriguing. The first official coins under the

Dollar system were minted in the late 1780's and, not much later, state

banks began minting their own individual currencies.

Left:

Massachusetts-Bay 7 dollar continental bill from 1780. Right:

Hand Signed Bank of South Carolina 5 dollar bill from 1807.

More than 30,000 state

bank notes with a variety of

colors, sizes, and designs, were issued across the nation. Due to a

lack of federal regulation, the bills were easily counterfeited and led

to major problems, both for the state banks and for consumers. To

complicate matters, along came the American Civil War which almost

bankrupt the country and forced congress to take action on the currency

situation. By taxing local state currencies out of existence with the

National Banking Act, the federal government was able to issue an

official nation-wide currency for the first time in the form of

non-interest bearing treasury notes called Demand Notes. This process

quickly led to the creation of Greenbacks in 1862 which were backed by

Spanish dollars. Counterfeiting had taken its toll, and the new

bills were designed with "fine line engraving necessary for

difficult-to-counterfeit intaglio printing, intricate geometric lathe

work patterns, and distinctive linen paper with embedded red and blue

fibers." The United States Dollar, as we know it, was established.

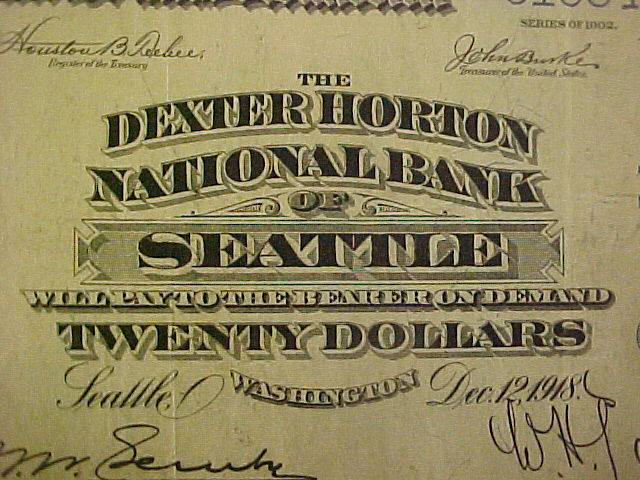

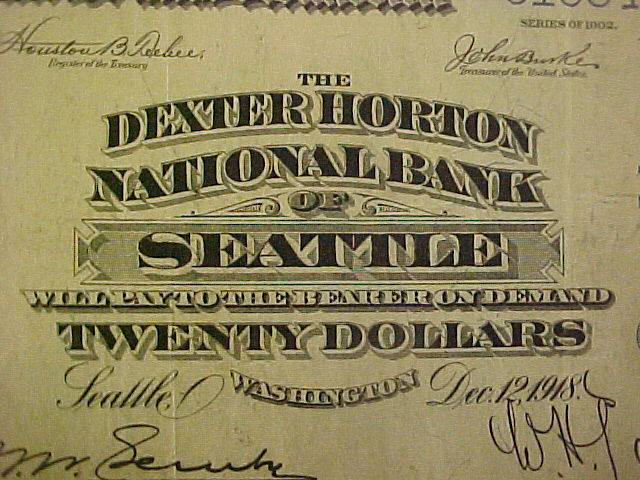

Dexter

Horton National Bank U.S. Dollar "National Currency" from 1902 backed

by "bonds deposited with the treasurer of the U.S."

x

There was one major difference

from those dollars of yesterday and

those we use today. From 1792 through 1874, the US dollar was

freely backed by both gold and silver. Under this system, dollars could

be exchanged for their set value in gold or silver from the U.S.

Treasury. Gold was traditionally the most popular unit of support

for the dollar but powerful factions in the silver producing industry

continually managed to influence policy. That is, until huge

silver deposits were discovered in Western United States in the late

1800s. This effectively devalued the silver content in U.S. coinage,

and sent the country into a furious debate over the bimetallic

standard. This led to a division of the democratic party in 1896 as

each side of the party argued with their own interests at heart.

The United States Greenback

Party, supported primarily by farmers, felt

that keeping the system of Bimetallism would be in their best interest

because it would lead to inflation, and consequently make it easier for

them to repay their land debts. On the other hand, financial

institutions and commercial businesses argued that a stable dollar was

more important than the farmers' predicaments, and that the dollar

should be backed only by gold to effectively achieve this stability. It

is little wonder that the farmers lost the battle and from 1873 to 1900

legislative modifications led to the introduction of the Gold Standard.

U.S.

Dollar Bison note from 1901. This United States Note was the only one

to mention the legal provision that authorized its issuance.

x

The Gold Standard Act passed on

March 14th 1900, and with that, all

dollars were backed entirely by gold. But, as the constant

evolution of the Dollar system has shown, complications and confusion

always seem to arise as the system becomes inefficient. In this

case, the dollars' stumbling began when the post-WW2 Bretton Woods

system valued all other foreign currencies in terms of U.S. dollars,

and consequently indirectly connected their currencies to the gold

standard. At the time, gold had a market price of $35.00 an

ounce; trying to maintain that market price under the pressures of

foreign currencies put a major strain on the system, and once again

resulted in looking at new ways of doing things.

After a failed attempt at creating a two-tier system in which central

bank gold transactions were insulated from the free market price, the

government took a radical step in 1971. They shrugged off the gold

standard and entered a new era by embracing a Fiat Money System as the

best course of action. This new way of doing things was simple:

Remove all physical assets backing the dollar. No conch shells. No

Spanish currency. No silver. No gold. The dollar would now be

backed by just a promise, or as Wikipedia.com states: "backed by future

claims to wealth of American Taxpayers and other income sources of the

Treasury." Thus the dollar went from being a claim on some

physical asset to simply a medium of exchange. Some have argued

that this means the only inherent value left in the dollar is the paper

it is printed on.

Federal Reserve Notes, for the

greater part of their history, always

had the words "Will Pay to the Bearer on Demand;" but by 1963, under a

burgeoning fiat money system, this was removed and by 1968 the

government would no

longer honor gold or silver certificate redemption. This does not mean

that old currency is worthless however. The government still respects

old bills at face value, although paying for your groceries with a

dollar from the 1800s is a pretty bad idea. As historical collectables

go, not many items divulge so much information about the character of

the United States at various times in history as the particular dollar

of that day. The pictures on old bills are such simple and

authentic representations of each period's values and politics, it is

not surprising that many vintage dollars sell for much more on the

antique market these days than they would have ever been worth in gold.

Under a fiat money system, the amount of

silver in coins was also drastically reduced. Where once most coins

contained 90% silver, after the Coinage Act of 1965 they rarely

contained any at all. By 1975 it seems all valuable commodities had

been removed from the monetary process (either in backing or content),

and the United States completely embraced a fiat system. Some

argue the foundation of the dollar is all a confidence game now.

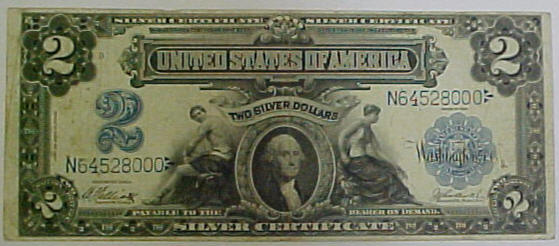

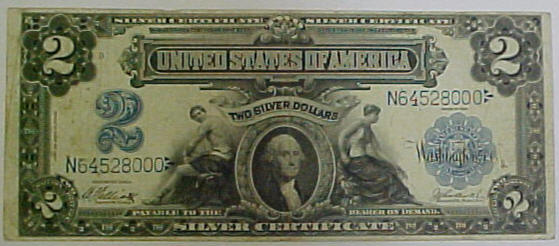

Silver Certificate from 1899

when U.S. Dollars were still backed by BOTH hard assets silver and gold.

x

As a strange as it would be for

a fur trader from the 1800s to

contemplate derivatives, stock futures, and puts and calls, so is it

tough for us to imagine what the future of our currency system might

entail. Technology is always advancing. Efficiencies are always

increasing. Our understanding of market economics is continuously being

pushed forward by experience.

These days, with high tech methods of safeguarding the authenticity of

our currency with such things as security thread and microprinting, the

new fear has become more about the authenticity of the person spending

those funds than the actual dollar bills themselves. In a world

of invisible money, identity theft is rapidly becoming a huge

problem. To battle this growing inefficiency in today’s currency

system, new ways of doing things are inevitable.

Perhaps the credit cards we use

today will be replaced by personalized

microchips under our skin tomorrow. Perhaps when we shop for groceries,

cashiers will be completely unnecessary. Perhaps when we leave the

store, our unique microchip (embedded somewhere on our body) and all

the unique microchips in each of our groceries will be instantly

scanned, charged to our account, and added to our monthly bill.

As distasteful as such a thing sounds now, imagine the fur trader

contemplating a currency with no physical assets backing it, or coins

with no actual value outside of being a medium of exchange. They

would probably think it a bit wacky too.

- Tim Regan